Number 1 – “The Downsizer”

This is a strategy that appeals to me – it shows the ability of how good legislation can meet real needs that actually exist in our community. This is an important basis not seen often.

What is it? Lets go into more detail…

“The Downsizer” is a totally unique addition to any good retirement financial planner’s arsenal. It allows you to invest in superannuation to aid your retirement upon the sale of your house; once you have met the usual list of required rules.

The direction of this strategy encourages retirees to free up their big empty family homes in those prime locations which gives lead way for families with young children to locate here.

Sounds great, right? However, when we probe further it really is not that unique. Investing into superannuation for the regular tax-free income payments in retirement is one of the most popular ways to fund endless enjoyable caravan trips and opportunity to spoil grandchildren.

What really makes this strategy be outstanding is that it pierces the arbitrary and ageist ceiling which says you must have done all your contributing prior to age 67 or its back to work you go. Otherwise as they say in the classics, do not pass go!

Let me explain by way of an example;

The Case Study

Darcy & Beth are both age 69 and are happily retired.

Together they worked hard all their lives as a mechanic and laundry worker respectively, to pay off their house & two hectares at Dayboro where they raised their three children.

When Beth was age 64, they elected to get her back fixed as it was interfering terribly with their quality of life. Unfortunately, this drained all their remaining financial assets. They didn’t complain and simply survived on a modest lifestyle with the full age pension.

Darcy’s dad passed away and their immediate plan was to move to a smaller property and invest the combined $500,000 they now had in their bank term deposit accounts.

Now, we will leave the weighing of competing strategies available to Darcy & Beth to best achieve what they really wanted for another day.

The beauty of The Downsizer strategy is that it gave them another option. An option that would have been available to them already if they were age 64 and we all know that five years flows can fly by in the blink of an eye.

I hope from this example it shows that you can see that the Downsizer strategy works for any number of people you already know, who for one reason or another were late to the superannuation party and have changed their mind too late. This usually will happen after talking to their friends and neighbours. I come into contact with people in this situation regularly and it always seems so unfair finding these people in such a situation.

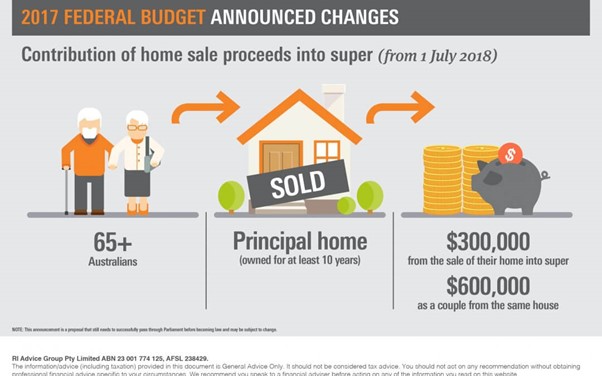

Key rules from the laundry list;

- Eligible to contribute if you are over age 65 and you sell your main residence that you have held for at least 10 years.

- Downsizer contributions can only be made once in your lifetime.

- Contributions are capped at $300,000 per person – it can be no more than the sale price of the principal residence.

- You only have 90 days from the settlement day to lodge the forms and contribute the funds unless granted an exemption.

The process for accessing the downsizer contribution isn’t as clever as the strategy and the rules have some allowances and plenty of traps.

I strongly suggest seeking the help of an expert and the tremendous team at Lifelong Wealth are highly experienced, fully equipped with a wealth of knowledge to be your financial guide and assist further.

Kent Thomas