The benefits of consolidating your superannuation fund – here are our tips

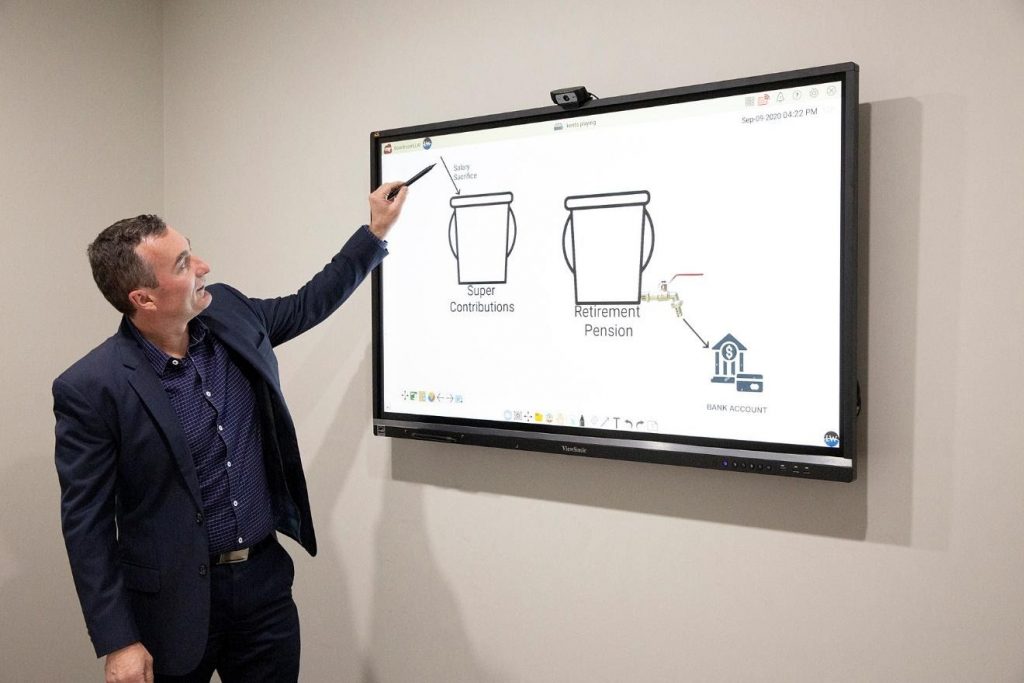

Do you know how much Super you really have? What about the super you earned from the short term job you did many years ago? It can be hard to keep a track of your Super if you have had many roles in the past (and therefore likely many accounts with different super funds). However, if you leave it all as is, you’re likely to lose money on fees, lose track of how much you have and where and overall create more inconvenience for yourself. So why should you consolidate your super?

By moving your super to one fund instead of the numerous you have accumulated over your years of work, you are able to:

- Save on fees

-

- Instead of paying annual fees for each fund, you are able to save that money and prevent your super from dwindling down due to multiple fund charges.

- Save time

-

- By only having one fund, you are reducing the time you spend on filling out paperwork and updating your details. This will also allow you to focus on the underlying investments instead of spending time trying to understand the range of products each fund has.

- Track your super

- Once you consolidate your super to one fund, you will have a better picture of your balance and what you need to do to reach your retirement goals. You will not need to worry about remembering all the log ins and passwords for your multiple funds, but you will be able to get a clear indication of your balance in one place.

Here are some of our tips on how to consolidate your superannuation fund.

- Search for lost super.

It can be surprising how many superannuation accounts you have opened over your work history that you might have lost track of. An employer must start paying you superannuation if you are paid $450 or more before tax in a month, so even if you think you only worked for a short while at a position, you still might have some lost super. We recommend completing a search by using your Tax File Number to try and find your lost super. Some new regulations in 2019 have also made this easier as superannuation funds must pay the ATO balances from inactive low-balance accounts which are kept safe for you until you are reunited. The best way to search for your lost super is to go online using MyGov. As this service will have all your details already, you will be able to complete the steps in no time. Other options to search for your lost super are to contact the ATO on their lost super search line (13 28 65) or completing a paper form.

- Understand your current situation

Before you consolidate your super, it is important to understand your current or main superannuation fund. Is this fund where you want to stay? Have you been invested appropriately and have received the expected returns? It is also important to consider your type of employer as some funds only accept super guarantee payments from certain employers. You might be a medical professional, teacher, or work for a large company who choose specific funds for their employees as it can provide certain benefits that you might not find at another fund. We recommend for you to get advice from a superannuation consultant or financial planner here at Lifelong Wealth as we can explain the ins and outs to you and provide holistic advice regarding retirement planning as well in North Brisbane.

- Consider insurance

If you have taken out personal insurance through your super, you will need to do a bit of research. If you move funds, you are likely to lose this insurance which could be very important depending on the products and your age. For example, if you have any pre-existing conditions or are aged over 60 you might not be able to get the same cover you have right now. We highly recommend you come in to see an adviser here at Lifelong Wealth to discuss this further so that you are still sufficiently protected. We will also be able to discuss with you your current insurance needs to make sure you are not over or underinsured.

- Choose your fund.

Come meet with a superannuation adviser to get superannuation advice as we will take some time to do research about which fund you would like to move to (if you did move), considering aspects such as monthly or annual costs, insurance premiums and return on investments. We can also discuss with you how the fund has performed the last few years and compare it to others and help you to establish a risk profile to see which products would be suited to you specifically. Once you are happy with a fund, we can assist you in moving over all your other accounts and help you complete the required documents.

Overall, consolidating your super funds will help you save time, save money, and help you keep track of your balances better, allowing you to reach your retirement goals. We would love to meet with you if you need assistance with this, so book an appointment today to get on top of your super!

Book an appointment with us today, or give us a call if you wanted to discuss these services further.